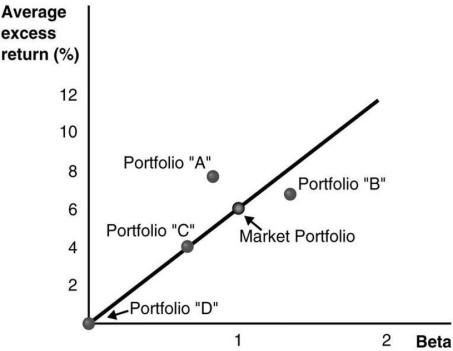

Use the figure for the question(s) below.Consider the following graph of the security market line:

-Which of the following statements regarding portfolio "A" is/are correct? 1.Portfolio "A" has a positive alpha.

2.Portfolio "A" is overpriced.

3.Portfolio "A" is less risky than the market portfolio.

4.Portfolio "A" should not exist if the market portfolio is efficient.

Definitions:

Pros And Cons

Pros and cons are the benefits and drawbacks of a specific action or decision, considered in order to make a balanced and informed choice.

Electronic Communication

the transfer of information between individuals or entities through digital means, such as email, instant messaging, or social media.

Client Confidentiality

An ethical obligation for professionals, such as lawyers, to keep their clients' information private and not disclose it without consent.

Violations

Acts or instances of breaking or failing to comply with laws, rules, agreements, or conditions.

Q10: What is the expected value of Rearden's

Q14: The level of incremental sales associated with

Q18: The correlation between the expected return and

Q19: Which of the following formulas is INCORRECT?<br>A)Div<sub>t</sub>

Q38: Which of the following statements is FALSE?<br>A)The

Q54: Following the borrowing of $12 and subsequent

Q59: Following the borrowing of $12 and subsequent

Q61: The expected return of a portfolio that

Q70: When all investors correctly interpret and use

Q78: Suppose that you borrow $60,000 in financing