Use the information for the question(s)below.

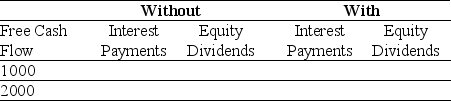

Consider two firms: firm Without has no debt, and firm With has debt of $10,000 on which it pays interest of 5% per year. Both companies have identical projects that generate free cash flows of $1000 or $2000 each year. Suppose that there are no taxes, and after paying any interest on debt, both companies use all remaining cash free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Definitions:

Homogenizing

The process of making things uniform or similar, often by reducing diversity or variations within a particular group or context.

King James Bible

An English translation of the Christian Bible commissioned in 1604 by King James I of England, which has had a profound influence on English-speaking Christianity and literature.

Burned At The Stake

A form of execution where the condemned person is tied to a large wooden stake and burned alive, historically used for heresy, witchcraft, and treason.

Mathematics

The abstract science of number, quantity, and space, either as abstract concepts (pure mathematics) or as applied to other disciplines such as physics and engineering (applied mathematics).

Q19: Luther Industries is considering borrowing $500 million

Q34: Consider the following equation: P<sub>retain</sub> = P<sub>cum</sub>

Q39: What does the existence of a positive

Q47: Suppose that you want to use the

Q48: The covariance between Stock X's and Stock

Q67: Assuming perfect capital markets, the share price

Q84: Suppose an investment is equally likely to

Q94: Which of the following statements is FALSE?<br>A)Aside

Q108: The Correlation between Stock X's and Stock

Q111: The Sharpe Ratio for Wyatt Oil is