Use the information for the question(s)below.

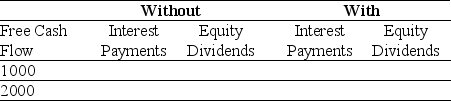

Consider two firms: firm Without has no debt, and firm With has debt of $10,000 on which it pays interest of 5% per year. Both companies have identical projects that generate free cash flows of $1000 or $2000 each year. Suppose that there are no taxes, and after paying any interest on debt, both companies use all remaining cash free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Definitions:

Formal Structure

The official structure of the organization.

Division of Work

The assignment of different parts of a manufacturing process or task to different individuals in order to improve efficiency.

Supervisory Relationships

The dynamic between supervisors and their subordinates, characterized by guidance, support, and oversight in a work context.

Organization Chart

A visual representation that shows the structure of an organization and the relationships and relative ranks of its parts and positions/jobs.

Q3: Nielson Motors plans to issue 10-year bonds

Q26: Assuming your cost of capital is 6

Q34: What range for the market value of

Q43: Which of the following equations is INCORRECT?<br>A)Var(R)=

Q65: Assume that MM's perfect capital markets conditions

Q68: If Wyatt adjusts its debt continuously to

Q76: The Volatility on Stock X's returns is

Q84: Suppose an investment is equally likely to

Q89: The cost of capital for the oil

Q96: If Wyatt Oil distributes the $70 million