Use the table for the question(s) below.

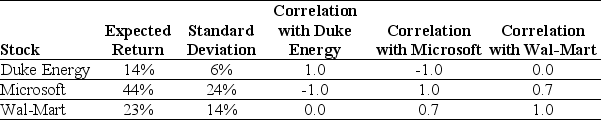

Consider the following expected returns, volatilities, and correlations:

-The expected return of a portfolio that is consists of a long position of $10000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

Definitions:

Total Revenues

The total amount of income generated by the sale of goods or services related to a company's primary operations.

Marginal Revenue Product

The additional revenue generated from using one more unit of a factor of production, holding all other factors constant.

Law of Diminishing Returns

This economic law states that after a certain point, successive increments of a single factor of production yield progressively smaller increases in output.

Competitive Market

A market environment where numerous producers and consumers interact, leading to price competition and variety in products.

Q3: The beginning of the modern theory of

Q17: Which of the following statements is FALSE?<br>A)As

Q20: The standard deviation for the return on

Q34: Assuming that your capital is constrained, which

Q36: Assuming that your capital is constrained, which

Q39: Wyatt Oil's average historical return is closest

Q54: The excess return if the difference between

Q71: Which of the following statements is FALSE?<br>A)Creditors

Q104: Which of the following influences a firm's

Q121: Suppose that Monsters' expected return is 12%.