Use the following information to answer the question(s) below

Assume that the risk-free rate of interest is 3% and you estimate the market's expected return to be 9%.

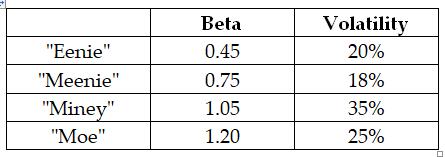

-Which firm has the most total risk?

Definitions:

Mound-Shaped

A description of a symmetrical, bell-shaped distribution often associated with the normal distribution.

P-Value

Represents the probability of observing test results at least as extreme as the ones observed, under the assumption that the null hypothesis is true.

Hypothesis Testing

The process of making decisions or inferences about a population based on sample data, often involving the use of a statistical test.

Test Statistic

A measure calculated from sample data during a hypothesis test used to determine whether to reject the null hypothesis.

Q23: The weight on Taggart Transcontinental stock in

Q23: Taggart Transcontinental has a value of $500

Q47: Consider an equally weighted portfolio that contains

Q54: Assume that investors in Google pay a

Q62: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2790/.jpg" alt="The term

Q64: Which of the following statements is FALSE?<br>A)When

Q65: Rearden's expected dividend yield is closest to:<br>A)3.40%<br>B)3.65%<br>C)4.00%<br>D)4.20%

Q70: Suppose you have $10,000 in cash to

Q81: Which of the following statements is FALSE?<br>A)An

Q85: The volatility on the market portfolio (which