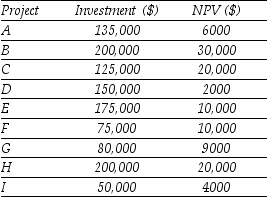

Use the table for the question(s) below.

Consider the following list of projects:

-Assuming that your capital is constrained,which investment tool should you use to determine the correct investment decisions?

Definitions:

Interest Rate

The rate of a loan designated as interest to the borrower, typically represented as an annual percentage of the loan's unpaid balance.

Present Discounted Value

The value of a future amount of money in today's terms, calculated by applying a discount rate to account for time and risk.

Payments For Capital

Funds disbursed to acquire or maintain fixed assets, like equipment or buildings, or to compensate the providers of financial capital.

Interest

The charge for borrowing money, typically expressed as an annual percentage of the principal.

Q14: At an annual interest rate of 7%,

Q16: The effective annual rate on your firm's

Q18: Which of the following statements is FALSE?<br>A)The

Q26: The expected return on security with a

Q37: The IRR for Boulderado's snowboard project is

Q39: You currently own $100,000 worth of Wal-Mart

Q42: Another oil refiner is offering to trade

Q76: Von Bora Corporation (VBC)is expected to pay

Q83: What is the standard deviation of Big

Q97: What is the expected return for an