Use the following information to answer the question(s) below.

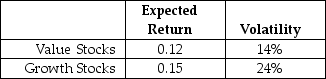

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-Which of the following is NOT an assumption used in deriving the Capital Asset Pricing Model (CAPM) ?

Definitions:

Effective Rate of Interest

The real rate of interest earned or paid over a period, considering compounding.

Compounded Options

Compounded options are not a standard financial term, suggesting a mix-up or confusion with terms related to compound interest or options trading. NO.

GICs

In Canada, Guaranteed Investment Certificates represent an investment option guaranteeing a fixed return rate over a certain time frame.

Annually

Happening annually or pertaining to a timeframe of one year.

Q11: The number of shares that Galt must

Q12: Which of the following is one unintended

Q13: The amount of Rosewood's interest tax shield

Q19: The incremental unlevered net income Shepard Industries

Q19: Which of the following formulas is INCORRECT?<br>A)Div<sub>t</sub>

Q44: Suppose that to raise the funds for

Q53: Consider the following formula: τ* = <img

Q69: Which of the following statements is FALSE?<br>A)It

Q85: The volatility on the market portfolio (which

Q98: Which of the following statements is FALSE?<br>A)Fluctuations