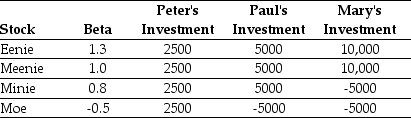

Use the table for the question(s) below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Peter's portfolio is closest to:

Definitions:

Amarna Period

A phase in ancient Egyptian history during the reign of Pharaoh Akhenaten, characterized by significant religious and artistic shifts, notably the worship of the sun disk, Aten.

Conservative

A political and social philosophy promoting traditional values and institutions, typically resistant to rapid change.

Formulaic

Pertaining to or based on a formula; following a fixed and conventional method or style, especially in art, literature, or music.

Palette

A flat surface on which an artist mixes paint colors, or metaphorically, the range of colors used in a particular painting or by an artist.

Q1: The expected overall payoff to Bank A

Q20: Which of the following statements is FALSE?<br>A)The

Q39: Suppose that when these bonds were issued,

Q42: Suppose over the next year Ball has

Q50: Assume that MM's perfect capital markets conditions

Q60: Assuming that Palin's cost of capital is

Q60: Suppose you are a shareholder in Galt

Q63: Which of the following statements is FALSE?<br>A)Without

Q70: Which of the following statements is FALSE?<br>A)Leverage

Q72: A stock's _ measures the stock's return