Use the table for the question(s) below.

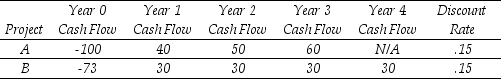

Consider the following two projects with cash flows in $:

-The maximum number of incremental IRRs that could exist for project B over project A is:

Definitions:

Direct Tax

A tax levied directly on an individual's or organization's income or wealth, such as income tax or property tax.

Indirect Tax

A tax collected by an intermediary from the person who bears the ultimate economic burden of the tax; examples include sales taxes and value-added taxes.

Social Security Tax

A tax levied on both employers and employees to fund the Social Security program, which provides benefits for retirees, disabled individuals, and survivors of deceased workers.

Personal Income Tax

A tax levied on individuals' earnings, including wages, salaries, and investment income, often progressive in nature.

Q3: In the US the Dodd-Frank Wall Street

Q5: Suppose that you are considering an investment

Q19: Assuming you currently have 10,000 Bbls of

Q35: Which of the following statements is FALSE?<br>A)Even

Q60: Suppose you plan on purchasing Von Bora

Q73: Which of the following statements regarding the

Q79: Calculate the total Free Cash Flows for

Q90: What are the implications of the efficient

Q91: The incremental cash flow that Galt Motors

Q108: The Correlation between Stock X's and Stock