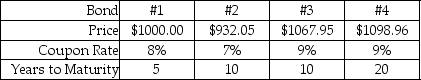

Use the following information to answer the question(s) below.Consider the following four corporate bonds that have semiannual compounding:

-If the YTM of these bonds increased to 9%,which bond's price would be most sensitive to this change in YTM?

Definitions:

Semiannually

A term describing events or actions that occur twice a year, typically every six months.

Investment Grade

A rating assigned to bonds that indicates they are of high quality and low credit risk.

Bond Grade

The rating assigned to a bond by credit rating agencies, reflecting the issuer's creditworthiness and the bond's risk level.

BBB

A credit rating assigned to bonds that are considered investment-grade, with a moderate risk level.

Q9: A project you are considering is expected

Q12: Accounts payable is a:<br>A)non-current (long-term)liability.<br>B)current asset.<br>C)non-current asset.<br>D)current

Q21: Which of the following statements is FALSE?<br>A)Stock

Q23: Perrigo's debt to equity ratio is closest

Q29: The specific cost of each source of

Q32: The expected return on the market portfolio

Q56: If its YTM does not change, how

Q65: Rearden's expected dividend yield is closest to:<br>A)3.40%<br>B)3.65%<br>C)4.00%<br>D)4.20%

Q70: Which of the following statements regarding the

Q106: The forward rate for year 2 (the