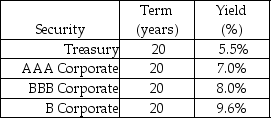

Use the following information to answer the question(s) below.

-Wyatt Oil is contemplating issuing a 20-year bond with semiannual coupons,a coupon rate of 7%,and a face value of $1000.Wyatt Oil believes it can get a BBB rating from Standard and Poor's for this bond issue.If Wyatt Oil is successful in getting a BBB rating,then the issue price for these bonds would be closest to:

Definitions:

Lapse

The termination or expiration of a legal right, policy, or agreement due to the passage of time or inaction.

Rescission

The act of unilaterally terminating a contract and returning all parties involved to the positions they were in prior to entering the contract.

Pre-Approved

Describes a preliminary endorsement, often in the context of finance, indicating eligibility for certain benefits or offers without final authorization.

Death Benefit

A sum of money paid by an insurance policy or retirement plan to the beneficiary upon the death of the insured person or plan holder.

Q22: Suppose you have $1,000 today and the

Q22: The internal rate of return rule can

Q34: The cost of capital can be thought

Q62: The approximate before-tax cost of debt for

Q64: Which of the following equations is INCORRECT?<br>A)

Q72: Luther Industries has a dividend yield of

Q73: Suppose that you want to use the

Q74: Explain why the expected return of a

Q75: Assuming that Defenestration's dividend payout rate and

Q137: In calculating the cost of common stock