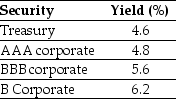

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

-The credit spread of the B corporate bond is closest to:

Definitions:

Medieval Monasteries

Religious communities or buildings where monks or nuns live, work, and pray, prevalent during the medieval period across Europe.

Alternate-Support System

In church architecture, the use of alternating wall supports in the nave, usually piers and columns or compound piers of alternating form.

Early Christian

Refers to the art and architecture of the Christian church from its inception up to the start of the Byzantine period, characterized by simple and symbolic forms.

Illuminated Manuscripts

Handwritten books that are decorated with gold or silver and vivid colors, often containing illustrations and ornamental designs.

Q2: The credit spread of the B corporate

Q15: Which of the following statements is FALSE?<br>A)When

Q19: If Moon Corporation has depreciation or amortization

Q31: The payback period for project beta is

Q31: Which of the following statements is FALSE?<br>A)An

Q33: If you sell this bond now, the

Q66: A 3 year default free security with

Q72: The British government has just issued a

Q78: The marginal cost of capital necessary to

Q79: Assuming that this bond trades for $1,035.44,