Use the information for the question(s) below.

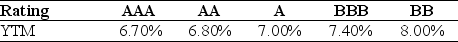

Luther Industries needs to raise $25 million to fund a new office complex. The company plans on issuing ten-year bonds with a face value of $1000 and a coupon rate of 7.0% (annual payments) . The following table summarizes the YTM for similar ten-year corporate bonds of various credit ratings:

-Which of the following equations is INCORRECT?

Definitions:

Finance Department

A division within a company that manages the organization's financial activities, including budgeting, forecasting, investment analysis, and financial reporting.

Watchdog Responsibility

The obligation of overseeing and holding accountable entities or individuals, particularly in financial or public interest contexts.

Common Stock

A type of security that represents ownership in a corporation, granting shareholders voting rights and a share in the company's profits via dividends.

Real Asset

Physical or tangible assets that have value, such as real estate, commodities, and natural resources.

Q14: What strategies are available to shareholders to

Q23: Suppose that Luther's beta is 0.9. If

Q24: If we use future value rather than

Q30: On the balance sheet, current maturities of

Q38: For the year ending December 31, 2012

Q58: Consider a bond that pays annually an

Q59: What is one of the incremental IRRs

Q62: Assuming that this bond trades for $1,112,

Q80: Which of the following statements is FALSE?<br>A)The

Q92: The NPV for the trucking division is