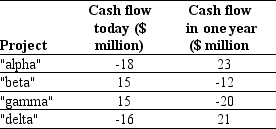

Use the table for the question(s)below.

-Assume that the risk-free interest rate is 10%.Rank each of the four projects from most desirable to least desirable based upon NPV.Which project would you invest in first? Are there any projects that you wouldn't invest in?

Definitions:

Put Option

A financial contract giving the holder the right, but not the obligation, to sell a specified amount of an underlying asset at a predetermined price within a specific time frame.

Market Value

The present cost at which a product or service is available for purchase or sale in the market.

Exercise Price

The specified price at which an option's holder can buy (call option) or sell (put option) the underlying security or commodity.

Stock Price

The cost of purchasing a share of a company's stock on the open market, dictated by supply and demand dynamics.

Q17: What decision should Galt Motors take regarding

Q34: If an investment providing a nominal return

Q48: If the current inflation rate is 5%,

Q60: Which of the following statements is FALSE?<br>A)The

Q67: Which of the following statements is correct?<br>A)You

Q79: The slope of the SML reflects the

Q84: Which of the following statements is FALSE?<br>A)A

Q87: Beta coefficient is an index of the

Q89: The firm's optimal mix of debt and

Q108: The forward rate for year 5 (the