Use the table for the question(s) below.

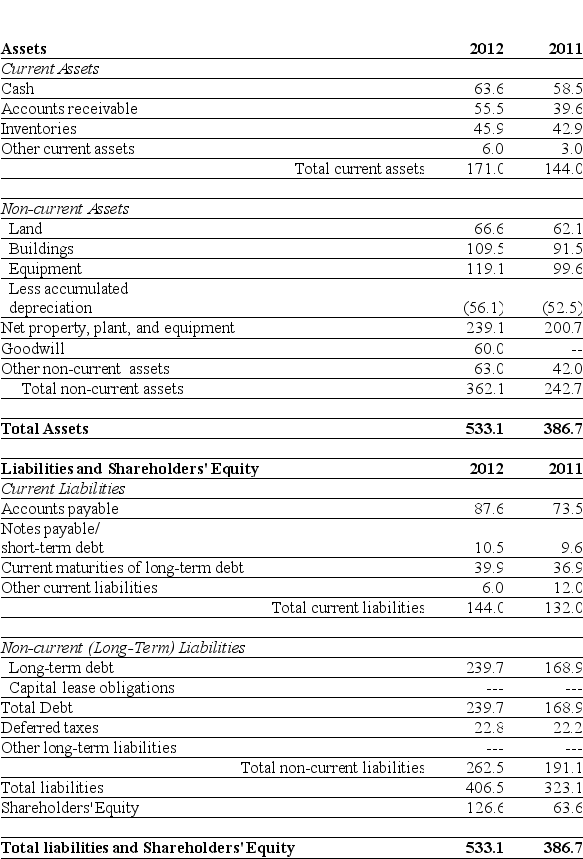

Consider the following balance sheet:

-If in 2012 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share, then Luther's Market-to-book ratio would be closest to:

Definitions:

Quantity-fixing Agreements

involve deals or arrangements between competing businesses to restrict output levels, aiming to influence market prices or conditions.

Price-leadership Model

A market strategy where one dominating firm sets the price for its product, and other firms in the industry follow suit, often observed in oligopolistic markets.

Dominant Firm

A company that has a large portion of market share in its industry, giving it significant power to influence market conditions and prices.

Economic Incentives

Monetary or other rewards used to motivate individuals or entities to perform certain actions beneficial to economic objectives.

Q11: Consider an ETF that is made up

Q38: For the year ending December 31, 2012

Q41: The _ of an asset is the

Q49: Luther's Operating Margin for the year ending

Q73: Consider the following timeline: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2790/.jpg" alt="Consider

Q81: An efficient portfolio is one that<br>A) maximizes

Q89: Dagny Taggart is a graduating college senior

Q112: Nico bought 100 shares of Cisco Systems

Q143: Key differences between common stock and bonds

Q171: A(n) _ portfolio maximizes return for a