Use the table for the question(s) below.

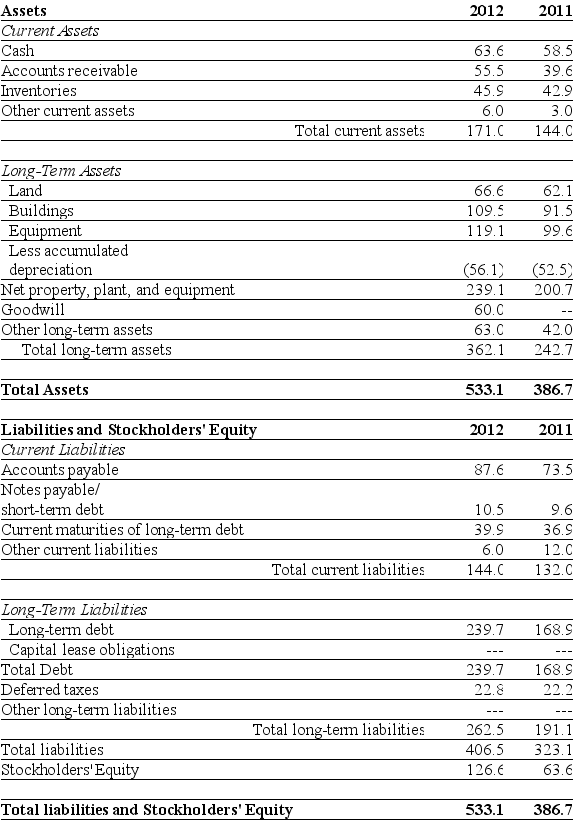

Consider the following balance sheet:

-If in 2012 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share, then using the market value of equity, the debt to equity ratio for Luther in 2012 is closest to:

Definitions:

P-value

The probability of observing data at least as extreme as the data observed, under the assumption that the null hypothesis is true.

Sample Mean

The average of all observations or data points in a sample, used as an estimate of the population mean.

Population Standard Deviation

A measure of the dispersion or spread of a population's values around its mean, quantifying variability.

P-value Method

A statistical approach used to determine the significance of results in hypothesis testing, indicating the probability of observing data as extreme as the sample data.

Q11: The number of outstanding shares of common

Q22: Your son is about to start kindergarten

Q29: The total amount of interest that Dagny

Q34: The percentage change in the price of

Q44: Which of the following statements regarding growing

Q49: Suppose the interest rate is 9% APR

Q58: Consider a bond that pays annually an

Q92: The beta of the market<br>A) is greater

Q107: Consider a bond that pays annually an

Q188: The portfolio with a standard deviation of