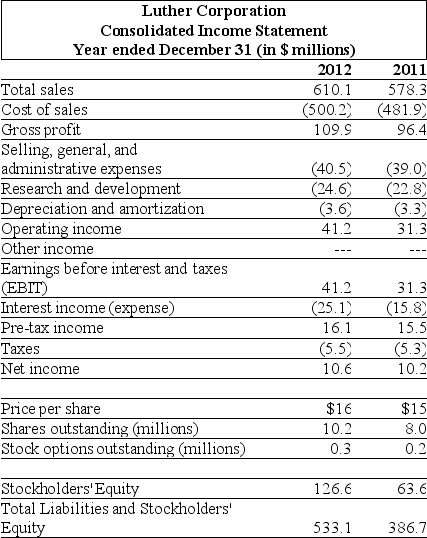

Use the table for the question(s)below.

Consider the following income statement and other information:

-Calculate Luther's return of equity (ROE), return of assets (ROA), and price-to-earnings ratio (P/E)for the year ending December 31, 2011.

Definitions:

Operating Revenues

Operating Revenues are the income earned from a company's core business operations, excluding non-operating income sources like investments.

Income Tax Expense

The amount of money a company owes in taxes based on its taxable income.

Income from Operations

The earnings generated from a company's regular business activities before taxes and interest, indicating the efficiency of core operational management.

Q1: Which of the following statements is FALSE?<br>A)U.S.

Q2: In computing the weighted average cost of

Q2: If you forgo the $2,500 rebate and

Q25: How do you calculate (mathematically)the present value

Q33: Assume the appropriate discount rate for this

Q46: The amount that the price of bond

Q60: Which of the following statements is FALSE?<br>A)The

Q80: Which of the following statements is correct?<br>A)You

Q89: Assume that the risk-free interest rate is

Q107: Most managers are risk-averse, since for a