Table 8.3

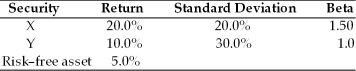

Consider the following two securities X and Y.

-________ in the beta coefficient normally causes ________ in the required return and therefore ________ in the price of the stock, all else remaining the same.

Definitions:

Non-directional

Pertaining to hypothesis testing, a hypothesis that does not predict the direction of the difference or relationship but merely asserts that a difference or relationship exists.

Alternative Hypothesis

A hypothesis that contradicts the null hypothesis, asserting that there is a statistically significant relationship between variables.

Non-directional

Refers to a type of hypothesis that does not predict the direction of the difference or relationship between variables.

Alternative Hypothesis

In hypothesis testing, the hypothesis that contradicts the null hypothesis, suggesting some effect or difference exists.

Q5: Tangshan China's stock is currently selling for

Q12: Any bond rated according to Moody's Ba

Q23: In an inefficient market, stock prices adjust

Q36: If the discount rate is 15%, then

Q53: The change in Luther's quick ratio from

Q84: _ in the beta coefficient normally causes

Q116: The _ is a statistical measure of

Q128: In the case of liquidation, common stockholders

Q133: BFG has current assets of $800,000, which

Q192: A firm has an issue of $1,000