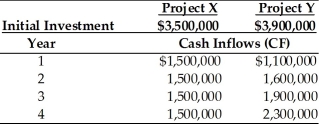

Table 12.5

Nico Manufacturing is considering investment in one of two mutually exclusive projects X and Y which are described below. Nico Manufacturing's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Nico estimates that the beta for project X is 1.20 and the beta for project Y is 1.40.

-Using the risk-adjusted discount rate method of project evaluation, find the NPV for projects X and Y. Which project should Nico select using this method? (See Table 12.5)

Definitions:

Trabeculae

The network of supportive fibrous bundles in organs like the heart or the spongy bone structure, providing structural support.

Spongy Bone

Also known as cancellous bone, a porous type of bone tissue found at the ends of long bones and in the inner layer of other bones, providing structural support.

Concentric Lamellae

Circular layers of bone matrix in osteons that surround a central canal, providing strength and support to bone.

Compact Bone

The dense, hard outer layer of bone that provides strength and support to the skeletal structure.

Q5: Benefits expected from proposed capital expenditures must

Q17: If Steve Jobs, the CEO of Apple,

Q39: Calculate the NPV of projects X and

Q69: Asymmetric information results when managers of a

Q99: Making financing decisions includes all of the

Q110: _ is the potential use of fixed

Q116: If an asset is sold for book

Q119: Poor capital structure decisions can result in

Q122: If a firm's variable costs per unit

Q168: The relationship between operating and financial leverage