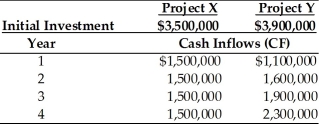

Table 12.5

Nico Manufacturing is considering investment in one of two mutually exclusive projects X and Y which are described below. Nico Manufacturing's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Nico estimates that the beta for project X is 1.20 and the beta for project Y is 1.40.

-Calculate the NPV of projects X and Y assuming that the firm did not employ the RADR method and instead used the firm's overall cost of capital to evaluate projects X and Y. (See Table 12.5)

Definitions:

Stimulus-Response Relationships

The connection between a specific stimulus and the behavior or reaction it elicits.

Conscious

The state of being awake and aware of one's surroundings and mental processes.

Unconscious Thought

Thoughts and processes that occur without an individual's aware perception, influencing actions and feelings.

Conditioned Stimulus

An initially neutral stimulus that becomes associated with an unconditioned stimulus to elicit a conditioned response after repeated pairings.

Q3: In partnerships, owners have unlimited liability and

Q5: Financial leverage may be defined as the

Q15: Cash outlays that had been previously made

Q26: The first step in the capital budgeting

Q33: Using the risk-adjusted discount rate method of

Q35: A firm has had the following earnings

Q43: Sensitivity analysis is a statistically based approach

Q88: The factors involved in setting a dividend

Q95: Generally, increases in leverage result in increased

Q201: The key differences between debt and equity