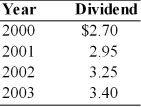

Tangshan Antiques has a beta of 1.40, the annual risk-free rate of interest is currently 10 percent, and the required return on the market portfolio is 16 percent. The firm estimates that its future dividends will continue to increase at an annual compound rate consistent with that experienced over the 2000-2003 period.  (a) Estimate the value of Tangshan Antiques stock.

(a) Estimate the value of Tangshan Antiques stock.

(b) A lawsuit has been filed against the company by a competitor, and the potential loss has increased risk, which is reflected in the company's beta, increasing it to 1.6. What is the estimated price of the stock following the filing of the lawsuit.

Definitions:

Surgical Instruments

Tools or devices used during surgical procedures to perform functions such as cutting, dissecting, grasping, holding, retracting, or suturing.

Surgical Instruments

Tools or devices designed specifically for performing surgical procedures.

Topical Anesthetic

A medication applied to a specific area of the skin or mucous membranes to numb the area and reduce pain sensation.

General Anesthesia

A medically induced state of unconsciousness with loss of protective reflexes, achieved using gaseous or intravenous drugs, to facilitate major surgical procedures.

Q15: Cumulative preferred stocks are preferred stocks for

Q18: Although preferred stock provides added financial leverage

Q26: The risk free rate of interest is

Q33: Tangshan China's stock is currently selling for

Q54: A hydrogen atom emits a photon of

Q56: Asset P has a beta of 0.9.

Q63: Using the data from Table 8.3, what

Q70: What is the expected return for asset

Q73: A firm has common stock with a

Q163: Under the Jobs and Growth Tax Relief