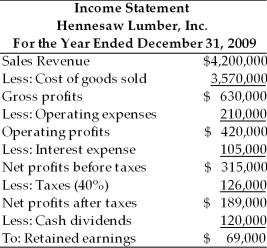

Table 4.4

Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2010, for Hennesaw Lumber, Inc.

Hennesaw Lumber, Inc. estimates that its sales in 2000 will be $4,500,000. Interest expense is to remain unchanged at $105,000 and the firm plans to pay cash dividends of $150,000 during 2010. Hennesaw Lumber, Inc.'s income statement for the year ended December 31, 2009 is shown below. From your preparation of the pro forma income statement, answer the following multiple choice questions.

-The pro forma cost of goods sold for 2010 is ________. (See Table 4.4)

Definitions:

Small Banks

Financial institutions with a smaller asset base and local focus providing banking services to individuals and businesses in their communities.

Primary Reserves

Funds that financial institutions must hold in physical form, such as cash in vaults or deposits with central banks, as a measure of liquidity and financial stability.

Secondary Reserves

Liquid assets held by financial institutions as backup funds for unforeseen needs, not directly utilized in lending or investment.

Required Reserves

The minimum amount of funds that banks are required to hold in reserve against deposits, as mandated by central banks.

Q8: The annual percentage yield (APY) is the

Q32: A firm has just ended the calendar

Q42: The major factor(s) affecting the cost, or

Q57: The ordinary income of a corporation is

Q76: The cost of giving up a cash

Q91: Time-series analysis is the evaluation of the

Q107: Calculate the current value of Bond M

Q156: A call feature in a bond allows

Q164: $100 is received at the beginning of

Q186: When the required return is constant and