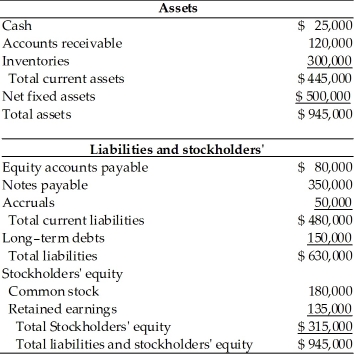

Table 4.5

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2015. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2015.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2014

-The external funds requirement results primarily from ________. (See Table 4.5)

Definitions:

Misconceptions And Myths

Incorrect beliefs or ideas that are widely held but baseless or unfounded in reality.

Chronic Pain

Persistent or recurring pain that lasts beyond the typical duration of healing, often without a clear cause.

Spinal Cord Injury

Damage to the spinal cord that results in a loss of function, such as mobility or sensation, below the site of the injury.

Paraplegic

A condition characterized by the partial or total paralysis of the lower half of the body, often resulting from spinal cord injury or disease.

Q22: An implication of the Efficient Market Hypothesis

Q27: The strict application of the percent-of-sales method

Q88: In a period of rising sales utilizing

Q89: As a rule, the necessary inputs to

Q98: What is the value of an asset

Q125: For the year ended December 31, 2008,

Q129: To buy his favorite car, Larry is

Q148: Another name for a deeply discounted bond

Q185: The pro forma cost of goods sold

Q204: The amount paid in by the original