Table 11.11

Nico Manufacturing is considering investment in one of two mutually exclusive projects X and Y which are described below. Nico Manufacturing's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Nico estimates that the beta for project X is 1.20 and the beta for project Y is 1.40.

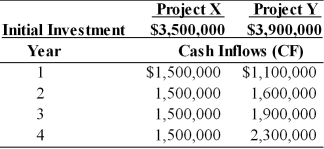

-Using the risk-adjusted discount rate method of project evaluation, find the NPV for projects X and Y. Which project should Nico select using this method? (See Table 11.11)

Definitions:

Unmet Customer Needs

Desires or requirements of consumers that are not being satisfied by current products or services on the market.

Differentiation

The process of distinguishing a product or service from others, to make it more attractive to a particular target market.

Existing Product

A product that is already available on the market and is not being introduced for the first time.

Hypothesizing

The process of forming a hypothesis, which is a proposed explanation made on the basis of limited evidence as a starting point for further investigation.

Q26: A financial manager must choose between four

Q39: In general, the greater the firm's operating

Q60: If you banked $27,778 today at an

Q67: The accounting in a stock split will

Q72: Consider the following projects, X and Y

Q93: If a firm's fixed operating costs decrease,

Q98: An asset was purchased three years ago

Q131: A firm has fixed operating costs of

Q184: _ costs are a function of time,

Q187: For Proposal 2, the tax effect on