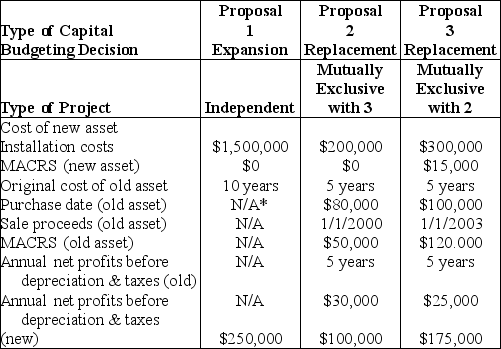

Table 11.4

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2004. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

*Not applicable

*Not applicable

-For Proposal 3, the annual incremental after-tax cash flow from operations for year 3 is ________. (See Table 11.4)

Definitions:

Direct Materials

Raw materials that are directly traceable to the manufacturing of a product and are a significant part of its composition.

Actual Cost

The actual amount spent on goods, services, and labor to produce an item or to run a company.

Data Collected

The process of gathering and measuring information on targeted variables to answer relevant questions and evaluate outcomes.

Direct Materials Price Variance

The difference between the actual cost of direct materials used in production and the standard cost, multiplied by the actual quantity of materials used.

Q6: _ is the risk to the firm

Q18: A mortgage is a form of loan

Q25: Cash flows that could be realized from

Q43: Profit maximization as the goal of the

Q73: Using the risk-adjusted discount rate method of

Q86: The agency problem occurs when the firm

Q90: A mixer was purchased two years ago

Q95: The financial manager recognizes revenues and expenses

Q105: In case of unequal-lived, mutually exclusive projects,

Q109: Financial leverage is concerned with the relationship