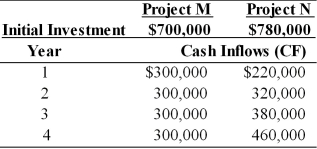

Table 11.9

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below. Tangshan Mining's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation, the NPV for project M is ________. (See Table 11.9)

Definitions:

Viral Illness

An infection or disease caused by viruses, such as the flu or common cold.

Antipyretics

Medications used to reduce fever or lower body temperature.

Lumbar Puncture

A medical procedure where a needle is inserted into the spinal canal to collect cerebrospinal fluid for diagnostic testing.

Q20: The discount rate (which is also known

Q21: If the firm in Table 10.4 has

Q48: Which of the following is not and

Q54: Yongman Electronics has decided to invest $10,000,000

Q74: The purpose of a reverse stock split

Q80: When evaluating a capital budgeting project, the

Q85: Using certain standardized and generally accepted principles,

Q100: The officer responsible for the firm's financial

Q103: A corporation is considering expanding operations to

Q119: Which type of dividend payment policy has