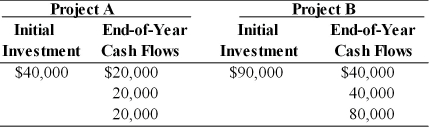

Table 10.4

A firm is evaluating two projects that are mutually exclusive with initial investments and cash flows as follows:

-The new financial analyst does not like the payback approach (Table 10.4) and determines that the firm's required rate of return is 15 percent. His recommendation would be to

Definitions:

Normally Distributed

A type of distribution in which data is symmetrically distributed around the mean, forming a bell-shaped curve.

Standard Deviation

A statistical measure that quantifies the amount of variation or dispersion of a set of data values, indicating how much the individual data points differ from the mean.

GPA Scores

A numerical calculation that represents a student's average performance across all their academic courses.

Confidence Interval

A range of numerical figures, deduced from the statistics of a sample, presumed to grasp the value of an indefinable population characteristic.

Q19: All of the following as considered stakeholders

Q21: Which statement is true?<br>A)The Internal Rate of

Q37: The corporate treasurer's focus tends to be

Q54: Refer to the table above. The overhead

Q79: The payback period of a project that

Q96: The cash flows of any project having

Q121: The minimum return that must be earned

Q139: A behavioral approach that evaluates the impact

Q143: Conflicting rankings in the case of mutually

Q182: Assuming a 40 percent tax rate, what