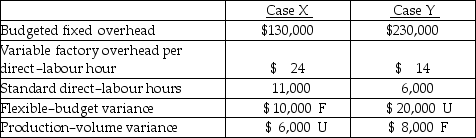

A company had the following information pertaining to two different cases:

-The total overhead variance in Case X was

Definitions:

Implied Volatility

The market's forecast of a likely movement in a security's price, often derived from the price of options on that security.

Black-Scholes

A mathematical model used for pricing European style options and understanding the dynamics of options markets.

Standard Deviation

Standard Deviation is a statistical measurement that represents the degree of variation or dispersion from the average, often used to quantify the risk of investment returns.

Market Call Premium

Additional amount above the par value that an investor must pay to call in a callable bond before its maturity date.

Q18: Since 1983 the standard meter has been

Q24: Which of the following is not a

Q25: Revenue divided by invested capital.

Q36: A usage variance measures actual deviations from

Q43: For Product X, the total actual quantity

Q49: A budget that adjusts for changes in

Q66: The rate of return used to compute

Q70: If the displacement of an object,x,is related

Q71: A cereal box has the dimensions of

Q89: The total flexible-budget variance for direct labour