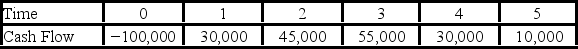

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.  Use the discounted payback decision rule to evaluate this project; should it be accepted or rejected?

Use the discounted payback decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Sales

The revenue generated from the selling of goods or services by a company or an enterprise to its customers.

Turnover

Sales divided by average operating assets.

Return On Investment

A performance measure used to evaluate the efficiency or profitability of an investment, expressed as a percentage.

Net Operating Income

The total profit of a company after operating expenses are subtracted from gross profit but before income taxes and interest expenses are deducted.

Q6: JackITs has 5 million shares of common

Q14: Compute the MIRR statistic for Project I

Q29: An electron microscope operates with electrons of

Q71: Apple's 9 percent annual coupon bond has

Q78: You are evaluating two different machines.Machine A

Q83: You own $14,000 of Diner's Corp.stock that

Q85: The area of management concerned with designing

Q96: A company has a beta of 4.5.If

Q105: Compute the MIRR statistic for Project J

Q112: Suppose that T-shirts,Inc.'s capital structure features 25