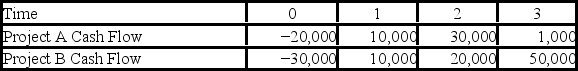

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.  Use the NPV decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the NPV decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Comprehensive Income

The change in equity of a company during a period from transactions and other events, excluding any changes resulting from investments by and distributions to equity claimholders.

GAAP

Generally Accepted Accounting Principles, a collection of standardized guidelines and practices for financial accounting in the United States to ensure consistency and transparency.

Comparative Financial Statements

These are financial statements that present data for multiple periods side by side to facilitate comparison and analysis of financial performance over time.

Retroactively Adjusted

Adjustments made to financial statements or other data for previous periods in light of new information or to correct errors.

Q1: If a self-sustained controlled fusion reaction is

Q1: As new capital budgeting projects arise,we must

Q6: JackITs has 5 million shares of common

Q34: An investor owns $2,000 of Adobe Systems

Q37: Which of these particles has the least

Q37: The net present value decision technique uses

Q56: Uptown Inc.has preferred stock selling for 102

Q61: An all-equity firm is considering the projects

Q129: Scribble,Inc.has sales of $80,000 and cost of

Q132: Suppose that Sam Industries has annual sales