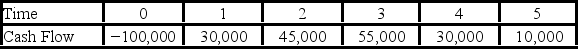

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.  Use the IRR decision rule to evaluate this project; should it be accepted or rejected?

Use the IRR decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Results-Oriented

An approach or mindset focused on achieving specific goals or outcomes.

Data Warehouse

A system designed for securely storing large volumes of critical data from various sources in a centralized location for easy access and analysis.

Data Warehouse

A centralized repository of integrated data from one or more disparate sources, stored for analysis, reporting, and data mining.

Data Depot

A repository or storage place where large amounts of data are held and managed.

Q3: The spacing between atoms in KCl crystal

Q8: What is the theoretical minimum for the

Q23: Compute the IRR statistic for Project X

Q32: When a high voltage is applied to

Q76: Would it be worth it to incur

Q77: When we adjust the WACC to reflect

Q83: TJ Industries has 7 million shares of

Q95: All of the following capital budgeting tools

Q97: Suppose that Jamie's Jams has annual sales

Q103: Suppose your firm is considering investing in