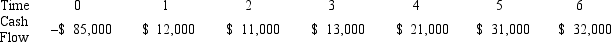

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the MIRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Self-values

Self-values pertain to an individual's core beliefs and principles that guide their behavior and decision-making.

Self-concept

An individual's perception of themselves, including their beliefs, feelings, and thought processes about who they are.

Self-esteem

An individual's subjective evaluation of their own worth or the degree to which they hold themselves in high regard.

Self-confidence

The belief in one's abilities, qualities, and judgment, contributing to personal and professional success.

Q6: KADS,Inc.,has spent $400,000 on research to develop

Q26: Which of the following particles is made

Q29: Which of the following will directly impact

Q42: Suppose your firm is considering investing in

Q44: Solar Shades has 8 million shares of

Q50: You are evaluating a product for your

Q89: Compute the NPV statistic for Project X

Q102: XYZ Industries has 10 million shares of

Q119: Suppose your firm is considering investing in

Q125: JLP Industries has 6.5 million shares of