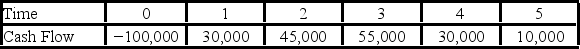

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.  Use the MIRR decision rule to evaluate this project; should it be accepted or rejected?

Use the MIRR decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Balance Sheet

Financial report presenting the total assets, liabilities, and equity of a company at a certain date, used to assess its financial stability and operational efficiency.

Assets

Assets are resources owned by a company that have economic value and can be used to meet debts, commit to investments, or generate income.

Liabilities

Future sacrifices of economic benefits that the entity is presently obliged to make to other entities as a result of past transactions or events.

Income Statement

A financial document that reports a company's financial performance over a specific period, detailing revenues, expenses, and net income or loss.

Q19: An alpha particle (mass = 6.68 ×

Q20: If you own 1,000 shares of Alaska

Q24: A photon absorbed by an electron will

Q41: In an analysis relating Bohr's theory to

Q42: You own $9,000 of Olympic Steel stock

Q43: Which process cannot occur if only one

Q57: Your company is considering a project that

Q77: A new project would require an immediate

Q88: For every stable nucleus except hydrogen,if the

Q89: An electron and an alpha particle (a