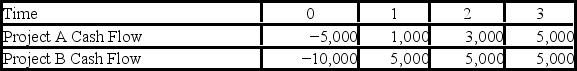

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.  Use the discounted payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the discounted payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Auspicious Objects

Items or symbols considered to bring good luck, prosperity, or positive outcomes, often used in cultural rituals and ceremonies.

Court Painter

An artist who held an official position in a royal or noble household, responsible for creating portraits and other artwork for the monarch or nobility.

Rent Collection Courtyard

A famous set of life-sized clay sculptures depicting the exploitation of peasants by landlords in feudal China, located in Sichuan province.

Sculptural Tableau

A three-dimensional artistic composition that creates a vivid scene or narrative, often involving multiple figures and detailed settings.

Q1: Suppose your firm is considering two mutually

Q5: The electron microscope's main advantage over the

Q10: If a firm has a cash cycle

Q13: Tritium has a half-life of 12.3 years.What

Q28: If a firm's inventory ratio increases,what will

Q63: Which of these makes this a true

Q93: Suppose your firm is considering investing in

Q107: You are evaluating a project for your

Q121: You are evaluating two different machines.Machine A

Q123: Which of these is an entity who