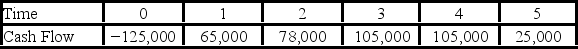

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 12 percent,and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years,respectively.  Use the NPV decision rule to evaluate this project; should it be accepted or rejected?

Use the NPV decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Target Profit

The amount of profit a company aims to achieve for a specific period.

Unit Sales

The total number of individual units sold.

Net Operating Income

The total profit of a company after operating expenses are subtracted from operating revenues, but before taxes and interest are deducted.

Units

A measure of quantity, referring to the individual countable items or grouped quantities of a product.

Q6: Which of the following is defined as

Q7: ABC Engineering just purchased a new machine.All

Q9: Suppose your firm is considering two independent

Q44: The quantum mechanical model of the hydrogen

Q47: Which of these statements is true regarding

Q55: What is the wavelength of the line

Q72: Which of the following will impact the

Q89: An electron and an alpha particle (a

Q89: Your company is considering a project that

Q90: Which of the following statements is true?<br>A)