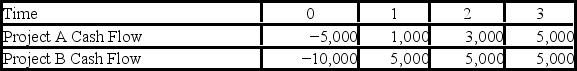

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.  Use the discounted payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the discounted payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Cost Curves

Graphical representations of the costs associated with producing varying quantities of output, illustrating concepts like marginal and average cost.

Purely Competitive Industries

Industries in which many firms sell identical products to many buyers and no single seller can influence the market price.

Economic Losses

The difference when total costs, including both explicit and implicit costs, exceed total revenues, indicating that resources could be better employed elsewhere.

Economic Profits

The difference between total revenue and total costs, including both explicit and implicit costs, representing excess returns over the firm's opportunity costs.

Q4: Which of the following statements is correct?<br>A)

Q4: A stock has an expected return of

Q8: If a firm has a cash cycle

Q25: Characteristic K x-rays are the result of:<br>A)inner

Q48: Your firm needs a machine which costs

Q58: You are evaluating a project for your

Q80: The study of the cognitive processes and

Q82: Which of the following is a concern

Q87: Which of these is a measure of

Q103: Suppose that Beach Blanket's common shares sell