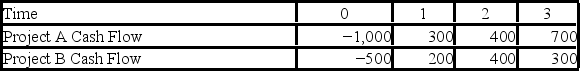

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.  Use the discounted payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the discounted payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Psychological Disorders

Mental health conditions characterized by significant disturbances in thoughts, feelings, and behaviors.

Therapy

A treatment method aimed at relieving or healing psychological disorders, physical disorders, or illnesses.

Modus Operandi

A particular way or method of doing something, especially one that is characteristic or well-established.

Treatment

Interventions designed to alleviate symptoms, cure illness, or improve health and well-being in a targeted condition.

Q15: The quantum number that can have only

Q20: When radium-224 emits an alpha particle,the remaining

Q22: HotFoot Shoes would like to maintain their

Q48: Suppose your firm is considering two mutually

Q49: PAW Industries has 5 million shares of

Q51: Suppose your firm is considering investing in

Q77: When we adjust the WACC to reflect

Q100: Esteé Lauder's upcoming dividend is expected to

Q101: If a firm has a cash cycle

Q121: You are evaluating two different machines.Machine A