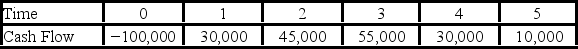

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.  Use the payback decision rule to evaluate this project; should it be accepted or rejected?

Use the payback decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Customers

Individuals or businesses who purchase goods or services from another entity.

Expected Value

The average outcome of a random variable, calculated as the sum of all possible values each multiplied by their respective probability of occurrence.

Raffle Tickets

Tickets sold as a means to raise money for a cause, with the chance of winning prizes.

Binomial Distribution

a probability distribution describing the number of successes in a fixed number of independent Bernoulli trials, with a constant probability of success.

Q18: Magnesium has atomic number 12.In its ground

Q37: Johnny Cake Ltd.has 10 million shares of

Q40: A 0.6-kg sample of a wooden artifact

Q49: PAW Industries has 5 million shares of

Q51: Which of the following is NOT included

Q56: All of the following capital budgeting tools

Q57: Suppose your firm is considering two mutually

Q66: If a hydrogen atom,originally in its ground

Q83: Which of the following is NOT a

Q113: Your company is considering a new project