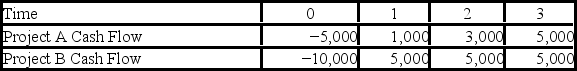

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.  Use the IRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the IRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Corporate Council

An advisory body or a group of legal experts providing counsel and legal services to a corporation.

Personal Management Skills

Abilities and competencies related to effectively managing one's own time, behaviors, and resources to achieve personal and professional goals.

Cyber Espionage

The practice of using digital techniques to conduct spying or gather secretive information from individuals, organizations, or governments.

Sexual Harassment

Unwelcome sexual advances, requests for sexual favors, and other verbal or physical harassment of a sexual nature in the workplace.

Q20: All of the following are the different

Q22: Oberon Inc.has a $20 million ($1,000 face

Q33: The advantage of a fusion reactor when

Q36: Which statement is true?<br>A) The larger the

Q54: How many possible IRRs could you find

Q57: Suppose that Model Nails,Inc.'s capital structure features

Q63: The microwave background radiation<br>A)represents the leftover glow

Q67: Calculate the range of the force that

Q69: The quantum mechanical model of the hydrogen

Q89: An electron and an alpha particle (a