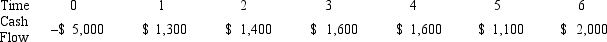

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

As-Needed Basis

A condition or situation in which actions are taken or resources are used only when required.

Appendix

An additional section at the end of a book or document, providing extra information, tables, or references not included in the main text.

Additional References

Additional references are supplementary materials or sources cited to support, clarify, or augment the information presented in a document, presentation, or research.

Questionnaires

A research instrument consisting of a series of questions for the purpose of gathering information from respondents.

Q7: PNB Industries has 20 million shares of

Q7: A proton and antiproton each with total

Q30: A company is considering two mutually exclusive

Q37: Which of these particles has the least

Q55: IBM has a beta of 1.0 and

Q64: FedEx Corp.stock ended the previous year at

Q90: You own $7,000 of Diner's Corp.stock that

Q104: In 2000,the S&P 500 Index earned 11

Q108: If the risk-free rate is 8 percent

Q114: Which of the following is the technique