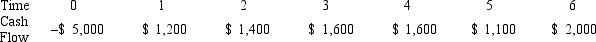

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the NPV decision to evaluate this project; should it be accepted or rejected?

Definitions:

Dendrites

Treelike fibers projecting from a neuron, which receive information and orient it toward the neuron’s cell body.

Synaptic Connections

These are the points at which nerve cells (neurons) connect to communicate with each other, transmitting signals through chemical messengers.

Anatomical Change

Alterations or modifications in the structure of body parts, often due to development, aging, or disease.

Egocentrism

The inability to differentiate between one's own perspective and someone else's perspective.

Q11: Which of the following will increase the

Q31: What is the maximum number of electrons

Q38: Investor enthusiasm causes an inflated bull market

Q41: You are evaluating a product for your

Q65: Concerning incremental project cash flow,which of these

Q67: FDR Industries has 50 million shares of

Q74: Which of the following is an index

Q76: Which of the following statements is correct?<br>A)

Q81: The optimal cash replenishment level will increase

Q91: If a firm's inventory ratio increases,what will