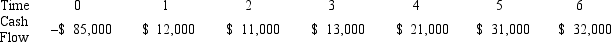

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the MIRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Growth Spurt

A rapid increase in height and weight, often occurring during puberty.

Visual-spatial Ability

The capacity to perceive, analyze, and understand visual information in the environment and to visualize and manipulate objects in space.

Personal Fable

The belief that our feelings and ideas are special and unique and that we are invulnerable; one aspect of adolescent egocentrism.

Reading Problems

Difficulties in recognizing written words, understanding them, and reading effectively.

Q14: Which force can act over distances comparable

Q17: The Bohr theory does not predict that<br>A)hydrogen

Q21: Sample #1 is made from an isotope

Q25: Suppose your firm is considering investing in

Q28: Suppose that Wave Runners' common shares sell

Q32: The Compton wavelength,h/m<sub>e</sub>c,equals 0.002 43 nm.In Compton

Q63: Which of the following is a checking

Q83: What is the energy of the scattered

Q93: FarCry Industries,a maker of telecommunications equipment,has 26

Q104: Your firm needs a machine which costs