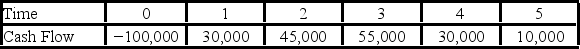

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.  Use the MIRR decision rule to evaluate this project; should it be accepted or rejected?

Use the MIRR decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Dissolution

The process of legally dissolving a corporation or partnership, effectively terminating its existence.

Winding Up

The process of closing a business, paying off creditors, and distributing any remaining assets to the owners or shareholders.

Liquidation

The process of converting a company's assets into cash to pay off creditors before ceasing operations or undergoing reorganization.

Fiduciaries

Individuals or organizations that are required to act in the best interest of another party, usually in a financial or trust-related capacity.

Q27: Which of the following statements is correct?<br>A)

Q31: Which of these is the process of

Q44: The quantum mechanical model of the hydrogen

Q53: Which of the following statements is incorrect?<br>A)

Q53: IVY has preferred stock selling for 98

Q58: Rose Resources faces a smooth annual demand

Q81: A decision rule and associated methodology for

Q84: Which of these is a capital budgeting

Q102: XYZ Industries has 10 million shares of

Q130: Painting,Inc.has sales of $400,000 and cost of