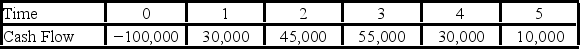

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.  Use the NPV decision rule to evaluate this project; should it be accepted or rejected?

Use the NPV decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Discrimination Complaints

Formal grievances raised by individuals who believe they have experienced unfair treatment based on illegal discrimination.

Human Rights Tribunal

A specialized body designed to hear and resolve complaints related to discrimination and violations of human rights.

Supreme Court Of Canada

The highest court in Canada that serves as the final court of appeal in the Canadian judicial system.

Inclusive Culture

A culture that values diversity and integrates all employees regardless of their differences, ensuring equal opportunities and respect for all.

Q4: There are samples of two different isotopes,X

Q12: The ratio of the numbers of neutrons

Q15: The original nucleus and the final nucleus

Q19: Which of the following statements is correct?<br>A)

Q42: Suppose your firm is considering investing in

Q63: Suppose your firm is considering investing in

Q66: The half-life of radioactive Technetium-99 is 6.0

Q92: Marme Inc.has preferred stock selling for 137

Q100: A capital budgeting technique that generates a

Q108: Rings N Things Industries has 40 million