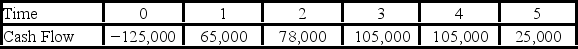

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 12 percent,and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years,respectively.  Use the MIRR decision rule to evaluate this project; should it be accepted or rejected?

Use the MIRR decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Financial Circumstances

An individual's or entity's current financial situation, including income, assets, debts, and expenses.

Social Connections

The relationships an individual has with others, including friends, family, coworkers, and other social networks, which can influence one's health and well-being.

Personal Safety

Measures and practices adopted to protect individuals from harm or danger.

Self-actualization

A concept in psychology referring to the realization or fulfillment of one's talents and potentialities, often seen as the highest need in a hierarchy of human needs.

Q5: At the beginning of the month,you owned

Q8: You are evaluating a project for your

Q28: Suppose that Wave Runners' common shares sell

Q33: According to de Broglie,as the momentum of

Q38: Which of the following is NOT one

Q57: An element is emitting alpha,beta,and gamma radiation.Rank

Q65: ABC Inc.has a dividend yield equal to

Q77: When we adjust the WACC to reflect

Q96: Suppose you sell a fixed asset for

Q98: Which of the following is a short-term