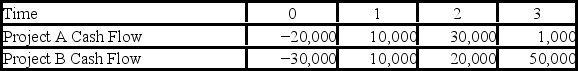

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.  Use the payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Q21: What is the energy needed to change

Q32: For most businesses,particularly smaller ones,the most common

Q34: According to the Rutherford model of the

Q47: A capital budgeting method that converts a

Q53: IVY has preferred stock selling for 98

Q54: You have a portfolio consisting of 20

Q67: You have been asked by the president

Q69: Your company is considering a project that

Q85: All of the following are necessary conditions

Q86: Which of the following is correct?<br>A) Hedge