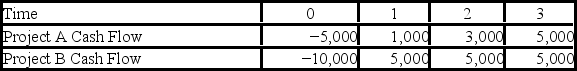

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.  Use the IRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the IRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Assertive

Behaving confidently and boldly, standing up for one's rights or opinions without being aggressive.

Uncomfortable

A feeling of physical or mental discomfort, often due to adverse conditions or ill-fitting situations.

AIDET

A communication framework used in healthcare standing for Acknowledge, Introduce, Duration, Explanation, and Thank You, aimed at improving interaction with patients.

Procedures

Established methods or actions for doing something, which in a medical context, could involve diagnostic or therapeutic actions.

Q31: In the reaction <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6864/.jpg" alt="In the

Q40: A disadvantage of the payback statistic is

Q58: Rose Resources faces a smooth annual demand

Q62: For which situation below would one need

Q65: Concerning incremental project cash flow,which of these

Q88: Imagine a firm has a temporary surplus

Q94: A manager believes his firm will earn

Q99: If a firm has a cash cycle

Q110: You own $2,000 of City Steel stock

Q112: Your firm needs a machine which costs