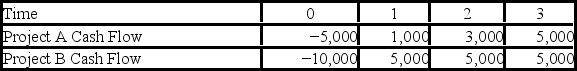

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.  Use the PI decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the PI decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Secured Loan

A type of loan that is backed by collateral, making it less risky for the lender since the collateral can be seized if the loan is not repaid.

Maturity Date

Due date of the promissory note.

Dividends

Payments made by a corporation to its shareholders, often as a distribution of profits.

Taxable

Refers to income, goods, or services subject to tax according to the laws of the taxing jurisdiction.

Q24: For which of the following transitions in

Q28: According to the standard model,a quark and

Q37: The net present value decision technique uses

Q39: The ground state electronic configuration for silicon

Q40: Processes in which one type of quark

Q48: Two different nuclei emit alpha particles,the energy

Q78: Which of the following makes this a

Q81: You are evaluating a project for The

Q117: When choosing between two mutually exclusive projects

Q137: If a firm has a cash cycle