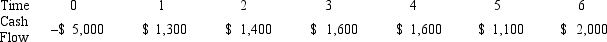

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

Accounts

Records within financial accounting that are used to keep track of increases or decreases in specific financial components, like assets, liabilities, equity, revenue, and expenses.

Dividends Declared

Dividends Declared are profits that a company's board of directors has decided to distribute to shareholders, but which have not yet been paid out.

Increase

An uptick in size, number, value, or strength.

Posting

The process of transferring journal entry amounts to respective accounts in the ledger.

Q9: The alpha radiation first classified by Rutherford

Q17: A company's current stock price is $65.40

Q58: Compute the PI statistic for Project Z

Q60: Which of these statements is true regarding

Q80: Suppose your firm is seeking a five-year,amortizing

Q85: All of the following are necessary conditions

Q87: The mass of <sup>12</sup>C is 12 u

Q91: If a firm's inventory ratio increases,what will

Q128: MC Enterprises estimates that it takes,on average,seven

Q131: Which of the following actions will cause