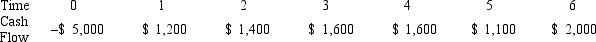

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the NPV decision to evaluate this project; should it be accepted or rejected?

Definitions:

Net Income

A company's overall earnings following the deduction of all expenses and taxes from its income.

Sunk Costs

Expenses that have already been incurred and cannot be recovered or altered, and should not affect future business decisions.

Project Analysis

Project analysis involves assessing the viability, impact, and feasibility of a project before financial resources are allocated.

Erosion

The gradual loss or decline of an economic or business value over time.

Q1: Suppose that PAW,Inc.has a capital structure of

Q3: If you own 300 shares of Alaska

Q11: Consider the hydrogen atom,singly ionized helium atom,and

Q31: Rate-based statistics represent summary cash flows,and these

Q40: For which of the following objects,each with

Q59: Consider the following reaction.<br>Π<sup>+</sup> + n →

Q73: If the stable nuclei are plotted with

Q88: Imagine a firm has a temporary surplus

Q97: Which of the following is another term

Q121: Drawing,Inc.has sales of $860,000 and cost of